By Winnie Kamau

Nairobi, Kenya: The State of Tech in Africa Report 2021 was launched in Capetown, South Africa. This report got me curious to know how the famed Tech space was doing in the midst of the Global Covid19 pandemic.

This report gives somes detailed insights and roadmaps for investors and Hubs in Africa’s Startup ecosystem which recorded the highest number of deals.

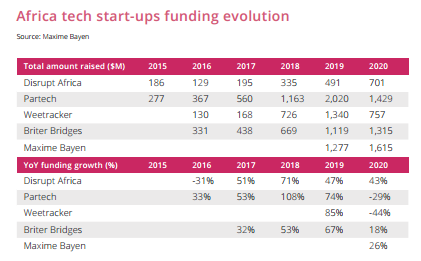

African Startups saw an increase of 44% in deals and a decline in the total value of deals by 29%.

The World Bank findings show a 4.3% contraction in the global economy, and Foreign Direct Investment into Africa declined by an estimated 18% in 2020.

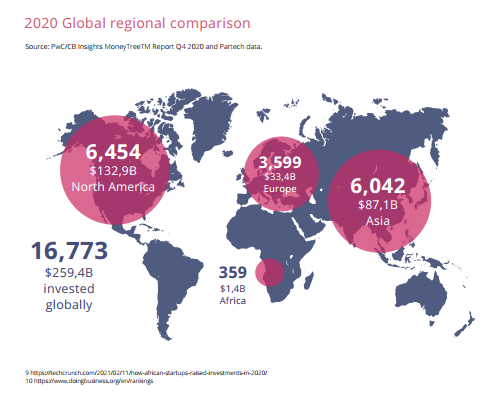

The report indicates that Africa underperforms in Venture Capital (VC) activity. Comparing the global view and the continent, Africa’s tech ecosystem is still miniscule as VCs invested $3.9 Million per day into African startups in 2020, while in the US, startups received VC investment of $428 Million per day.

In 2020 saw a sharp increase in the number of deals in the early-stage. Seed stage startups secured 7.5% of the total deal value in 2019, and 22% in 2020.

This for many will say is a drop in the ocean. But why would the 3rd most populous continent suffer such a setback, I ask.

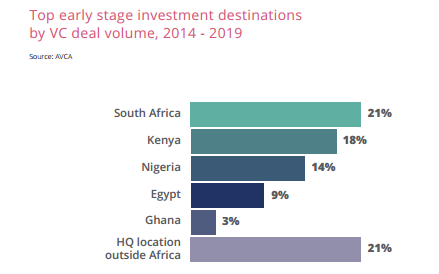

Africa’s governance model has been its biggest impediment in the evolving world of Startups. Many startups that raise capital in Nigeria are not incorporated in Nigeria.

The Startups owned by Nigerians usually setup their offices in other countries though they are working on solutions for Nigeria, this is because the country ranks considerably low in “Ease of doing business”.

Africa’s second largest Startup ecosystem is Kenya, they had a $5.80 per capita in VC investment in 2020 which is the highest in the continent. Kenya is also touted as a top destination for expats.

Why Nigerian and Kenya Models

Coming back to the challenge of setting up business in Africa, the report came up with two models that have been embraced by startups in Africa. A very peculiar way of circumventing the strict and bureaucratic ways of doing business in Africa.

Startups in Africa approach investors in two main models, the report shows. The first is the “Nigerian way” where you incorporate your company outside the country. The second is the “Kenyan way” whereby they seek capital within their country of incorporation.

While markets in Southern Africa are attracting more investments because of lower valuations. The Egyptian market has gained investor traction because of the huge population of almost 100 million.

There is an increasing need for countries to enact legislation. Frameworks like “Startup Acts”, to make it easier for businesses to incorporate locally, making it easier to start a business as an entrepreneur, but also to start a local investment fund and invest in seed stage businesses from the country.

There is an increasing need for countries to enact legislation. Frameworks like “Startup Acts”, to make it easier for businesses to incorporate locally, making it easier to start a business as an entrepreneur, but also to start a local investment fund and invest in seed stage businesses from the country.

Early-stage investors much prefer doing due diligence in-person, but struggled to do so in 2020 because of travel restrictions. Nevertheless, investments in early-stage startups were very bullish in 2020, as shown by the numbers of deals which were on the rise, even though their size was smaller.

Innovation Sectors

The degree to which Africa’s tech innovation and investment landscape has been impacted by COVID-19 pandemic is a mixed bag of results. On one side, the number of deals have increased, while on the other side the total value of the equity deals have decreased. This shows that investment appetite in tech innovation in Africa is still high.

Tech hubs across the continent play an important role in incubating and accelerating innovation that aimas to make early-stage startups investor ready. However, tech hubs themselves are in need of support, whether from government or private sector, in order to have the financial and operational muscle needed.

The Fintech, once again, captured a quarter of the equity funding with multiple big deals conducted, including Flutterwave’s astronomical rise and acquisition deals such as DPO and Paystack.

Nigerian startups continue to dominate the Fintech sector, largely due to fair regulations being put in place by major banks and the large population that remains unbanked and unconnected.

Nigerian startups continue to dominate the Fintech sector, largely due to fair regulations being put in place by major banks and the large population that remains unbanked and unconnected.

Flutterwave a Nigerian fintech company processed more than 80 million transactions, worth $7.5 billion in 2020 alone. Furthermore, Flutterwave closed a milestone Series C round of $170 million in March 2021 – giving them Unicorn status at $1 billion valuation

“Africa is not a country, but we make it feel like one” says Olugbenga Agboola, Co-founder

& CEO, Flutterwave.

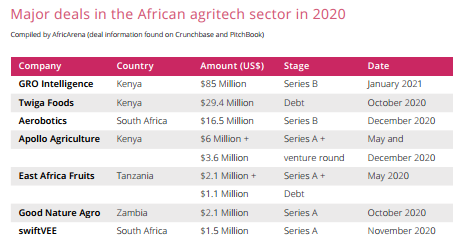

The Agritech sector also grew phenomenally in 2020, with Kenya leading the way, mainly because of massive deals such as the $85 Million raised by GRO Intelligence, and other big deals in Twiga Foods and Apollo Agriculture.

The Agritech sector also grew phenomenally in 2020, with Kenya leading the way, mainly because of massive deals such as the $85 Million raised by GRO Intelligence, and other big deals in Twiga Foods and Apollo Agriculture.

“We are seeing a uniqueness in African agriculture problems & challenges that justifies the need for locally built solutions” notes Benji Meltzer, Co-founder and CTO, Aerobotics

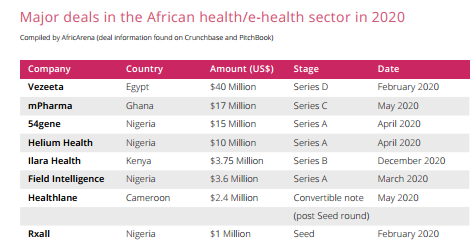

While the Healthtech saw a huge uptake in the number of deals, by 115%, across multiple markets. The biggest deal in this sector was a Series D raise of $40 million by Vezeeta. We can expect this sector to continue to grow because of the digital opportunities presented by the pandemic.

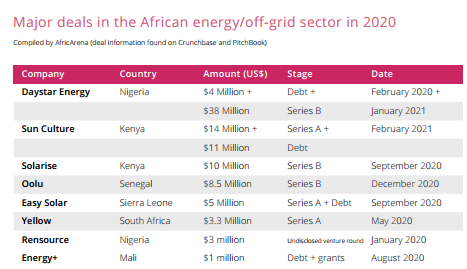

The energy/ off-grid tech sector retained its importance in Africa’s economy by securing deals close to $150 million in multiple markets. Africa’s energy sector speaks more to impact investors than traditional VCs, and that is a trend we can expect to continue says the report.

Top Four

Global VC data values show that Africa as a region expressively underperforms, but even within the continent there are countries which significantly outperform others.

According to the Partech report, Nigerian startups received the most investment in 2020 at a total value of $307m in 71 deals, and an average deal size of $4,3m. This is 59% lower than the $747m invested in 38 deals at an average of $19,7m in 2019.

In 2019 Nigeria also received the most investment in terms of value. In fact, the top four countries remained the same in terms of value invested in the same rank, Nigeria, Kenya, Egypt and South Africa.

Challenges of African Startups

The greatest challenge in marshalling up the report was in data collection because of the undisclosed deals in the continent ranging from $114 million to $400 million. With some investors choosing to be discreet about their deals in order to focus more on returns, while other investors announced their deals in order to be known by founders.

Investors also point out how difficult it is to start a business and invest in Nigeria explains Keeple Africa Ventures.

“I had to spend a year to finish the registration of my local entity in Nigeria, and to get my business permit and residence permit. Until you get a residence permit, you cannot even have a local bank account, so I was unbanked for the past year. These things negatively affect investors’ sentiment and are very discouraging, actually. Unless they significantly improve the ease of doing business” says Keeple.

Adding “It’s very difficult to see more foreign VCs having local operations. If you don’t have lots of VCs having local operations, it’s difficult to close the gap that we see in investment for seed-stage startups. It’s very difficult to invest remotely into seed stage startups” he says.

In second place, Kenya received $305m in 52 deals in 2020 averaging $5,9m per deal (second behind Ghana for the highest average deal value). The value of deals in the Kenyan market declined by 46% while the number of deals stayed constant at 52 (with the average also dropping 46%).

In second place, Kenya received $305m in 52 deals in 2020 averaging $5,9m per deal (second behind Ghana for the highest average deal value). The value of deals in the Kenyan market declined by 46% while the number of deals stayed constant at 52 (with the average also dropping 46%).

One of the Investors noted the increase in Kenya was due to the offers says FMO.

“Over the last couple of years, East Africa and Kenya in particular has seen a lot of interest from development-oriented or impact investors, especially in certain sectors including off grid energy. This seems to have had an elevating impact on valuations, if compared to, for instance, South Africa which is less of an impact ‘sweet spot’ but offers very interesting opportunities” says FMO.

Another comment we heard is that the East-African region, and Kenya in particular, has a number of expats, which makes it more appealing for foreign investors to invest, as there is a level of familiarity.

“Yes, it’s easier for foreign investors to invest in Kenya, it’s easier for entrepreneurs also to come from other regions and set up a business. So it’s easier to get talent here, it’s easier to settle here, the government has ensured that foreign investment is not interrupted and capital can flow in the country quite easily. So that is very, very attractive for many people in comparison to Nigeria where the business environment is different. In Nigeria you will find more local entrepreneurs as opposed to East Africa and that creates a difference in how people allocate capital” says Goodwell Investments.

Adding “For example in logistics in Kenya, in comparison to a similar logistics business in Nigeria, you find that Nigerian businesses might have better traction, and have grown in all areas better than the Kenyan business, but a Kenyan business has higher valuation. It has also been driven mostly by, American VCs, so they kind of look at this environment, from a Silicon Valley perspective” explains Goodwell Investments.

The peculiarity in Kenya is also in the Venture capital investment as a proportion of GDP is the highest in Africa at 0,32% of GDP which is higher than the same ratio for Asia (0,27%) and Europe (0,16%) but behind North America (0,57%) and the US (0,61%).

The peculiarity in Kenya is also in the Venture capital investment as a proportion of GDP is the highest in Africa at 0,32% of GDP which is higher than the same ratio for Asia (0,27%) and Europe (0,16%) but behind North America (0,57%) and the US (0,61%).

Elsewhere on the continent Startup Acts are being proposed and have been implemented already in Tunisia (in 2018) and Senegal (in 2019). The Atlantic Council discussed some of the countries that have considered Startup Acts in Africa.

“Rwanda and Ghana, have both started discussions with key stakeholders in the last few months (of 2020). Even larger economies, such as Kenya, Ethiopia, and Uganda, have jumped on the bandwagon and are in various stages of passing their own versions” says the report.

South Africa on the other hand because of its Seed investors being limited by mandate to invest in foreign companies. It has been in a sticky situation in the South Africa as the market is not friendly enough for foreign investors to set up offices using the Kenyan model. Startups struggle to raise seed funding locally if they follow the Nigerian model.

South Africa on the other hand because of its Seed investors being limited by mandate to invest in foreign companies. It has been in a sticky situation in the South Africa as the market is not friendly enough for foreign investors to set up offices using the Kenyan model. Startups struggle to raise seed funding locally if they follow the Nigerian model.

The Egyptian market has gained considerable traction aided by the strong demographic fundamentals of 100 million plus population and growing financial inclusion and internet penetration. As well as the positive effect of the MENA region’s high profile exit with Careem as a number of previous Careem employees started their own businesses in Egypt.

The 80 paged report was commissioned by AfricArena Summit and the research was done by Partech Research seeking to give insights and knowledge on trends seen in theAfrican tech sector.