By Albert Mwangeka

The United Nations UN has warned African countries against heavy unsustainable borrowing which could injure growth of their economies.

Instead UN has advised African governments to seek other means of adding new revenue sources to finance development such as remittances, public-private partnerships and clamp down on illicit financial flows.

2016 United Nations Conference on Trade and Development UNCTAD report launched on Thursday in Nairobi Economic Development in Africa Report 2016 has revealed that Africa’s debt ratios appear manageable but African governments must take action to prevent rapid debt growth from becoming a crisis as it was experienced in the late 1980s and 1990s.

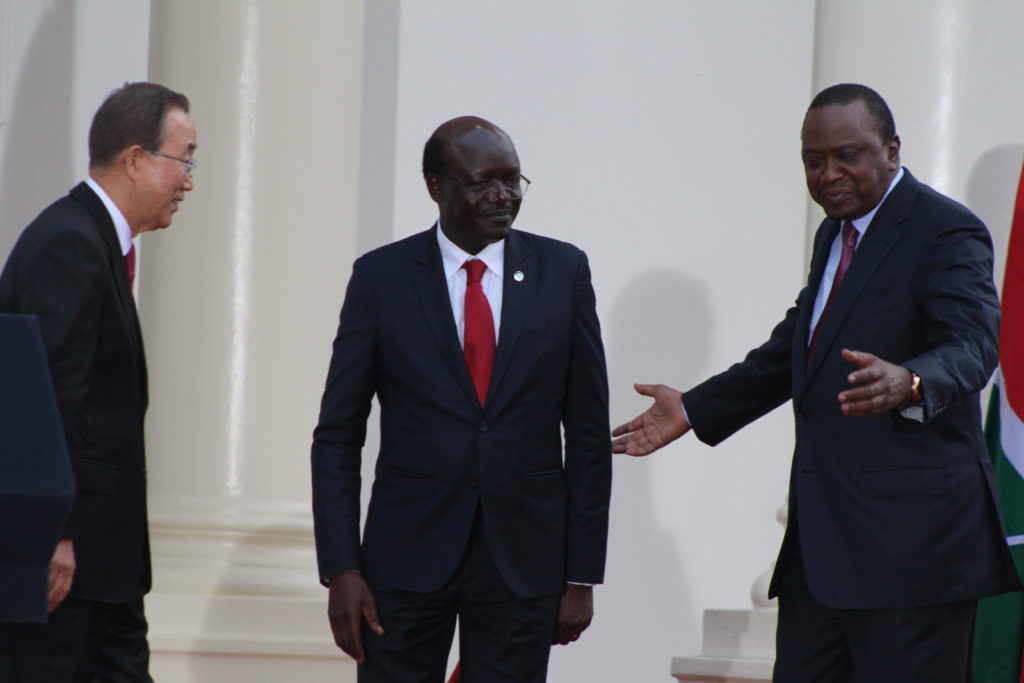

“The main worrying emerging trend is the rapid expansion of public debt over the past few years. We would not like history to repeat itself whereby African governments are struggling with debt,” Explained UNCTAD Secretary General Dr. Mukhisa Kituyi.

“Another concern is when a large part of this debt is in foreign currency, especially if it is being used to fund projects that do not generate foreign exchange. It is advisable for borrowing to be used to finance investments,” added Patrick Osakwe, UNCTAD’s Head of Trade and Poverty.

Osakwe also cautioned,” A country may have a debt ratio that is sustainable but something adverse might happen like declining oil prices, which might make the debt ratio unsustainable. Governments need to be aware of such vulnerability shocks.”

Dr. Kituyi has noted that there are seven African countries that are at risk of having debt distress.

Burundi, Central African Republic, Chad, Djibouti, Ghana, Mauritania and Sao Tome and Principe have been quoted by the report as countries with high risk of high debt distress.

Kenya has been mentioned by the report as having low risk of debt distress.

“Apart from international debt there has also been expansion of domestic debt. In 1995 domestic debt stood at 11% of GDP by 2013 it had risen close to 19%.That means that in the last 2 decades Africa’s domestic debt has doubled,”Dr. Kituyi said.

Osakwe said that in case of domestic and external debt proper policies should be formulated to ensure composition and structure of the debt is such that there are no problems in the future.

The report suggests complementary sources of financing like tapping into the Public Private Partnership PPP, giving appreciation for diaspora remittances and stemming illicit flows out of Africa.

However the UNCTAD Secretary General has lamented that PPP in Africa is not vibrant as such unions exist predominantly in the telecommunications industry.

At least $600 billion will be needed each year to meet the UN backed SDGs in Africa,’ said the report.

“Many countries have begun the move away from a dependence on official development aid to achieve SDGs with new and innovative sources of finance,” Dr. Kituyi concluded.