By Winnie Kamau

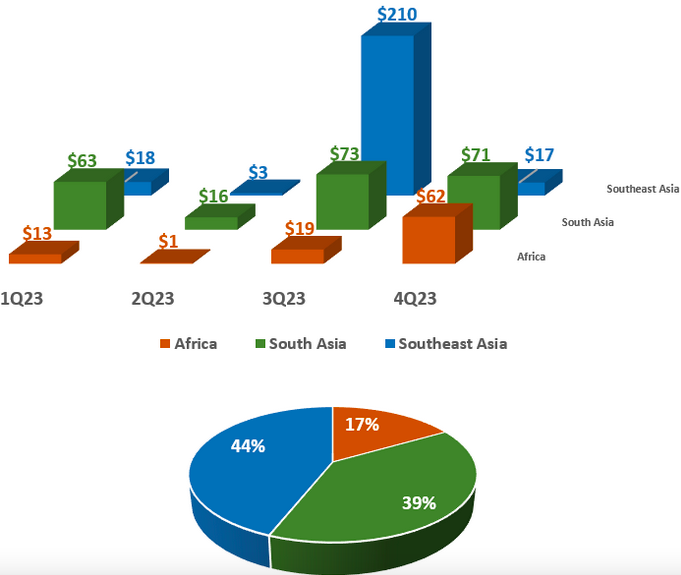

Nairobi, Kenya: In 2023, the spotlight shone brightly on Africa’s agritech landscape, amidst a global backdrop of substantial investment in the sector. AgrisTechia’s meticulous tracking unveiled a total of USD 564 million injected into agritech startups across three key regions.

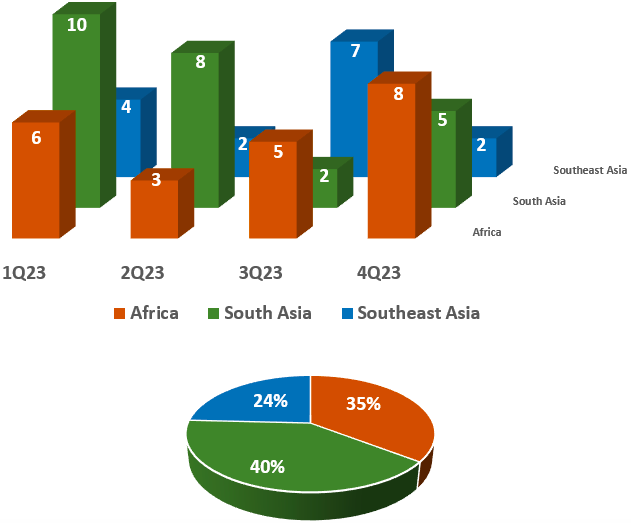

This funding surge encompassed ventures dedicated to bolstering smallholder agriculture, with a tally of 56 reported deals spanning various financing mechanisms, including grants, debt, and equity. Additionally, six undisclosed deals further underscored the dynamic nature of the sector.

A comparative analysis of funding distribution across regions revealed an intriguing narrative. While Southeast Asia emerged as the frontrunner, closely trailed by South Asia, Africa showcased a commendable effort despite facing challenges.

With USD 94 million raised, African agritech enterprises captured 17% of the total investment pie, signaling a growing interest in the continent’s agricultural innovation potential.

Notably, Kenyan agritech firms spearheaded the charge, securing 59% of Africa’s funding share and solidifying the country’s status as a regional agritech powerhouse and a global leader in the field.

Key deals in East Africa, including Apollo Agriculture’s USD 9.5 million expansion loan and Twiga Foods‘ USD 35 million debt funding, highlighted the region’s strides in leveraging technology to address agricultural challenges.

Ghana also made notable strides, securing over USD 12 million in funding, with ventures like Complete Farmer making significant strides in precision agriculture and market linkages.

Despite a somewhat subdued start to the year, Africa’s agritech scene remained vibrant. Notably, the region witnessed a diverse array of investments, extending beyond Kenya to include emerging hotspots like Morocco, Liberia, Uganda, and Zambia.

The rise of “multi-country deals” underscored a trend of startups venturing beyond borders to tap into broader regional markets, with initiatives such as OKO Insurance’s B2B expansion and TomorrowNow’s climate adaptation efforts across multiple East African countries.

As Africa navigated its agritech landscape, securing smaller average ticket sizes compared to other regions, it nonetheless showcased resilience and innovation.

While Kenya maintained its regional leadership, the continent as a whole witnessed a burgeoning ecosystem of agritech innovation, fueled by investments like Cavex’s USD 6 million infusion to scale its pan-African digital carbon financing platform.

Through such initiatives, Africa’s agritech sector poised itself for sustainable growth and impact across the continent and beyond.