By Winnie Kamau

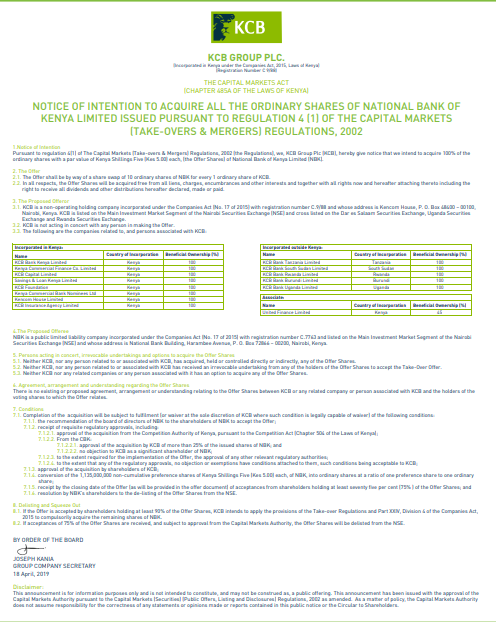

One of East Africa’s biggest lender by assets, KCB Group has offered to buy 100% of National Bank of Kenya. The acquisition is set to be through a share swap consisting of one KCB share for every 10 of National.

Through a media statement, the Management of National Bank announced the offer. This will see the Regional bank strengthen its asset base and shares in Kenya.

The Board of National Bank in acknowledging receipt said they would consider the offer in detail and consult widely amongst their Shareholders and the regulators.

The offer marks the second major deal among lenders since the government capped commercial lending rates in 2016. CBA Group, a privately held bank, is in process of merging with NIC Bank in a deal which has been approved by shareholders of both parties.