By Jared Osoro

Despite the comparative advantages Kenya possesses to be an industrial hub in Sub-Saharan Africa, the sector in Kenya has well continued to punch below its weight.

As Kenya puts in place targeted policies and necessary legal and regulatory reforms necessary for the private sector to thrive and therein lies a window of opportunity to recalibrate the countries’ strategies to touch on green sustainable and climate smart solutions – It might just be the needed elixir to an industrial sector on eternal inertia.

In doing so, Kenya will be joining a bandwagon of global governments and enterprises adopting climate investment compliant policies, leveraging on availability of lower costs of clean technologies and a collective voice from Paris Agreement clamouring for global warming to be maintained at under two degrees Celsius.

These have meant that economies and enterprises can now, therefore, invest in climate-resilient infrastructure that can effectively compensate for higher upfront costs from efficiency gains and fuel savings. Enterprises investing in sustainability initiatives have seen net effects on their bottom lines.

Even with these global-level green financing opportunities, local existential barriers exist – slowing down green pipeline and investment growth. Lack of a proper policy and regulatory initiative at local and international level to support scaled-up development of green pipeline has topped the charts. Limited data on investment viable prospects has followed in tow.

Those barriers have been at the core of the existence of Green Bonds Program – Kenya (GBPK), working on an accelerated programme to popularise and institute a green bonds market ecosystem and its effective take-up as a tool for Kenya to tap into international and domestic capital markets to finance green projects and assets.

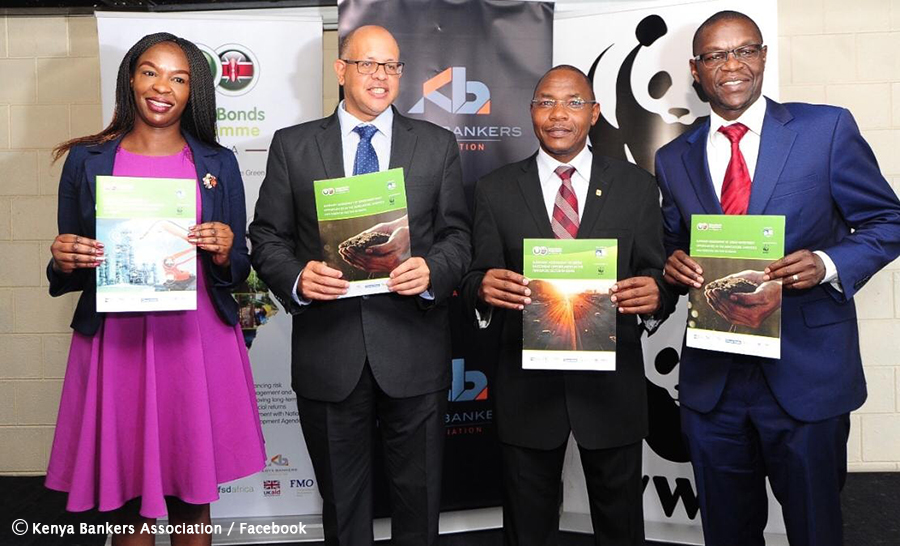

Strategically, informed by these known barriers and to establish the potential of green bond issuance in Kenya and as such develop a pipeline of green investments – GBPK in partnership with WWF Kenya and Kenya Bankers of Association (KBA) commissioned and released a report: Demand Study on Green Finance to quantify the investment opportunity for green investments in Kenya, identify barriers to the issuance of green bonds and solutions for creating bankable projects. The report finds proliferated opportunities in the manufacturing, transport and agriculture sectors.

In the manufacturing sector, the Demand Study earmarks five areas; energy efficiency and production process improvements, renewable energy, waste management, agro-processing and product innovation as areas that provide investment and financing opportunities key to address sustainability and climate change issues in that sector. It puts the finance demand at Shs. 4.4billion ($44m) and Shs.10 billion ($107million) in the short and long-term.

Some of the conspicuous risks highlighted that constrain green bond issuance within manufacturing include the view held by the local green bond issuers on Greenfield nature of projects within manufacturing, fragmented policy and lack of enforcement of regulations, political interference in implementation of areas such as urban waste management projects and limited technical skills of what green projects entails.

The Demand Study recommends for multi-stakeholder partnerships that build a robust and viable pipeline of deals, creation of a pooled fund for bond issuance in the sector and a review of improved enforcement and regulatory compliance across the board among a repertoire of solutions.

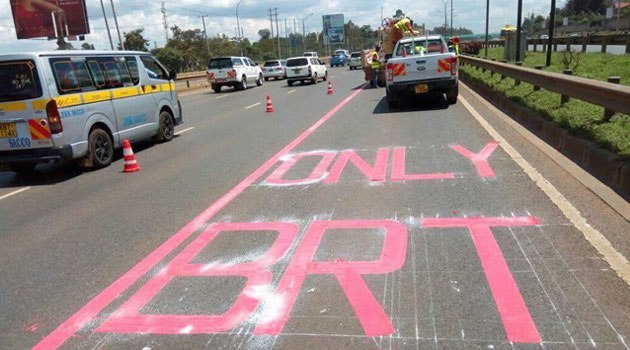

The transport sector reported as the second largest source of anthropogenic carbon dioxide (CO2) emissions (for its utilization of petroleum-based fuels) provides an immediate finance opportunity of between Shs. 8billion ($8 million). The medium-term opportunity grows to over Shs.58 billion ($580 million). The oft-mentioned light rail and Bus Rapid Transit (BRT) model Nairobi and Mombasa form a bulk of these high impact projects.

Agreeably, the Study finds an apparent need for political goodwill at national and county government level for successful project execution as well as funding mechanisms as a constraint. It recommends for a raft of solutions such as prioritization of key impact projects in the MTP III such as BRT and city rail.

Agriculture, a key cog of Kenya’s economy contributing to 30% of GDP and over 50% of employment is listed among the top source of emissions. The sector comes with a Shs.3.5 billion ($35 million) opportunity in the short term to over Shs. 18 billion ($180 million) dollars per year in 5-10 years across the various subsectors in Agriculture.

Penetration of the smallholder farmer market, initial capital required to start investments pose as a barrier for many new entrants whilst risk perception of the sector and long payback periods for some investments also limits access to capital.

With such opportunities and data available for green financing, Kenya is arguably in a good bubble to invest in green, sustainable and climate smart solutions.

The author is a Director of Research and Policy, Kenya Bankers Association.